AARP (American Association of Retired Persons) Medicare Supplement Insurance also known as Medigap. This insurance coverage is offered by private companies, it covers the expenses incurred by original Medicare such as co-payments, You can understand it like this that if the cost of your hospital treatment is $20,000, then original Medicare will cover only 80% of that cost. You will need a Midigap plan to cover the remaining 20%. co-insurance and deductibles, in this blog article today we will understand in great detail about AARP.

Detailed features of AARP Medicare Supplement.

1. Comprehensive coverage: Apart from the fact that AARP covers Medicare Supplement plans, you should also know that it is not covered under original Medicare at all.

2. Need for flexibility: You should be well aware that you should be prepared to cover the cost of your entire treatment, so such plans allow you to get services from any doctor or hospital through this plan, you will get the benefit of this plan only if the hospital accepts Medicare.

3. Need for international coverage: Let us tell you that sometimes this plan can be needed in an emergency situation while traveling abroad, in such a situation, this plan covers medical emergencies very closely while traveling abroad. This plan is going to be needed the most by those people who travel abroad a lot.

4. Less expense on your pocket: If you take Midigap plans, then it can completely save your pocket expenses. This clearly means that you can get your necessary care without worrying about medical bills without any tension. Remember to use this plan, you should go to only those hospitals which accept this plan.

5. Greater access: This plan gives you the flexibility to choose any specialist doctor you like, you can contact any specialist doctor of your choice and get the treatment you want.

6. No referral required and more convenience: If you choose to get treated by a specialist doctor, you will not need any referral, this plan makes the process very easy and helps you get the care you need very quickly. This plan also provides you with great protection during international travel. It can be the best companion for those who travel a lot, especially overseas.

Types of AARP Medicare Supplement Plans

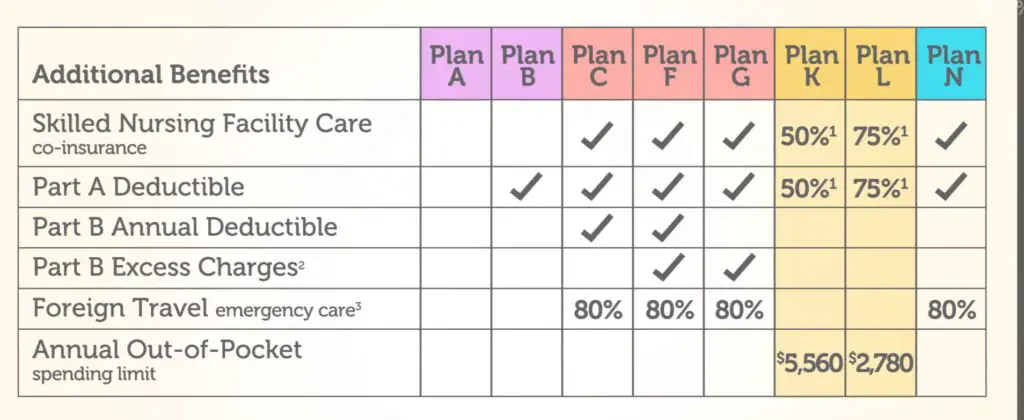

1. Plan A: This plan is the most basic plan, if we call it a basic plan then there will be no mistake. Shiplan covers hospitalization co-insurance and additional expenses in a detailed manner.

2. Plan B: This plan includes the entire benefits of Plan A, in addition, it also fully covers the deductibles of Part A.

3. Plan C, F: This plan provides the most comprehensive coverage in a very good way, but its biggest drawback is that it is not available at all for new Medicare beneficiaries. If you are a new Medicare beneficiary, then this can be a matter of some sadness for you. Because this plan is designed only for old Medicare beneficiaries.

4. Plan G: This plan is completely similar to Plan F, but does not cover the deductible of Part B. While taking these plans, you should check them thoroughly, otherwise in haste you will choose the wrong plan, due to which you may suffer huge losses.

5. Plan K, L: You have to take this plan only if you cover the remaining balance from the insurance company. This means that this plan reflects the concept of cost sharing. Through this plan, you can cover only a few percent of the expenses, the rest of the expenses will have to be borne by the insurance company. This process may seem difficult to you, but this plan can also prove to be very beneficial for you.

6. Plan M, N: If we talk about this plan, then from my point of view, you should avoid this plan. Because this plan provides very limited coverage, apart from this its premium is also low. Therefore, you should keep all these things in mind while buying the plan.

How to get AARP medical supplement and eligibility for it.

1. Becoming an AARP Member: You can get this offer only after becoming a member of AARP, to get membership you can visit their website and take membership by paying. After taking membership you become fully eligible for this offer.

2. Evaluation of needs and comparison of plans: Keep in mind that you should keep some things in mind while choosing the right plan, because if you choose the wrong plan, then you may face difficulties in recovering the entire expense. Therefore, choose your plan according to your healthcare needs and budget. Compare AARP Medicare supplement plans thoroughly and buy a plan according to your requirement.

3. AARP Eligibility: First of all, for AARP eligibility, you must be 65 years of age or older, but if you are disabled in some cases, then you can be eligible even at an age below 65 years. Apart from this, it is mandatory for you to be a member of AARP, so keep all these issues in mind while buying the plan.

Your question, my answer.

1. Is AARP Medicare Supplement Plan available in all states: The answer is yes. Let us tell you that this plan is available in every state but the rules and options of coverage may be different in some states. But the plan is available in every state.

2. Do I have to undergo a health test for AARP Medicare Supplement Plan: The answer is that if you apply for a plan in the last six months under Medicare Part B, then you will not have to undergo any kind of health test.

3. Can I change the AARP Medicare Supplement Plan at any time: The answer is yes. You can change the plan at any time but you have to undergo a health test for this but the insurance company can underrate you. So you must keep these things in mind while changing the plan, otherwise you may get a big shock.

4. Are free health services included in AARP Medicare Supplement Plans: The answer is no. This plan can only reduce your out-of-pocket expenses, not completely free.

5. Does AARP Medicare Supplement Plans include claim coverage: The answer is no. This plan does not include any kind of drug coverage, if you need drug coverage then please specifically analyze the Part B plan