Oplus_0

Sun Life Insurance is an insurance company, which was established in Canada in the year 1865. In today’s era, no one knows when a person will leave this world, in such a situation the need for companies like Sun Life Insurance increases. Sun Life Insurance Company has been fulfilling the most important needs of its customers by providing comprehensive insurance plans for many years. In this article, we will understand and discuss in detail why Sun Life Insurance is important for you, what is its specialty, its various plans and their benefits.

What are the major plans of Sun Life Insurance

1. Life Insurance: The purpose of life insurance plan is to provide secondary security to your family after your death. Let us tell you that if you are a responsible person of your house, the whole house is run by your earnings, then life insurance is no less than a boon for you. Because God forbid, if you die due to any reason, then your family will have to face a lot of difficulties in living life. In such a situation, if you have taken life insurance, then life insurance can meet the expenses of your family. Let us tell you that there are different types of life insurance plans, such as term life insurance and universal life insurance.

2. Health Insurance: Let us tell you that health insurance plan is important for you because this insurance covers your medical expenses very well. Such as hospitalization, surgery, claims and other medical services. And you will also know very well that in this situation the expenses of people increase a lot. In such a situation, if you have health insurance, then you will not face any kind of problem.

3. Education Insurance: The need of education insurance will prove to be a boon for every person who goes through financial difficulties in completing his studies. In such a situation, education insurance tries to completely cover the expenses of higher education.

4. Retirement Plan: If you are in any job, then you will know very well how important retirement plan is for you. Retirement plan is a very good companion of your old age. Let us tell you that retirement plan provides you financial security after your retirement. If you invest regularly in this plan during your tenure, then you are given a very good fixed amount at the end of the policy period. You can use that money for your children’s education or any other work.

Getting started with Sun Life Insurance

1. Assess your needs: Getting started with Sun Life Insurance is very easy. Just follow the steps below to choose the insurance plan that best suits your needs. If you are facing any problem in purchasing BHIM plan from Sun Life Insurance, you can visit their official website and ask for help.

2. Compare different plans: If you are going to buy an insurance plan, then first of all compare different BHIM plans according to your needs.

3. Consult an expert: While buying any insurance policy, you must do a deep investigation once. You can consult an expert, this will prove to be a very good decision for you. Because an expert helps you to choose the plan according to your needs and budget.

4. Complete the application process: If you have consulted your expert and selected the right plan, then after that you should complete the application process as soon as possible. While completing the application process, you will have to submit some necessary documents. Apart from this, you will also have to complete the formalities along with the documents. You can also get this work done from your expert. But if you are able to do this work yourself, then you can do it without any hesitation.

5. Invest regularly: If you have bought an insurance policy, then after that you should invest regularly. And pay the premium at the right time. So that your policy remains active, you will get proper benefits only after the policy remains active.

What are the benefits of Sun Life Insurance

1. Comprehensive coverage: Sun Life Insurance offers many types of insurance plans for you. Which fulfills different needs for your life. Let us tell you that this coverage helps to protect you and your entire family from every kind of uncertainty. Now if you want a better future for your entire family and yourself, then you must choose comprehensive coverage.

2. Financial stability: Let us tell you that if you suffer from any accident or disease, then you will know very well that a lot of money can be spent on your accident or disease. Due to which you may have to face secondary difficulties. In such a situation, if you choose this plan, then you will not have to go through financial difficulties. Because this plan provides you secondary assistance, after getting financial assistance, you will not have to face difficulties for your family.

3. Tax benefits: You can get benefits under the Income Tax Act on the amount you invest under your insurance plan. Due to this, your future tax liability reduces to a great extent. Due to this, you can get financial benefits.

4. Peace of mind is very important: Let us tell you that insurance plan provides peace to your mind in a very good way. When you have an insurance plan, you are safe from uncertainties for yourself and your family. After taking an insurance plan, you do not go through any kind of mental stress and enjoy your life without any worries.

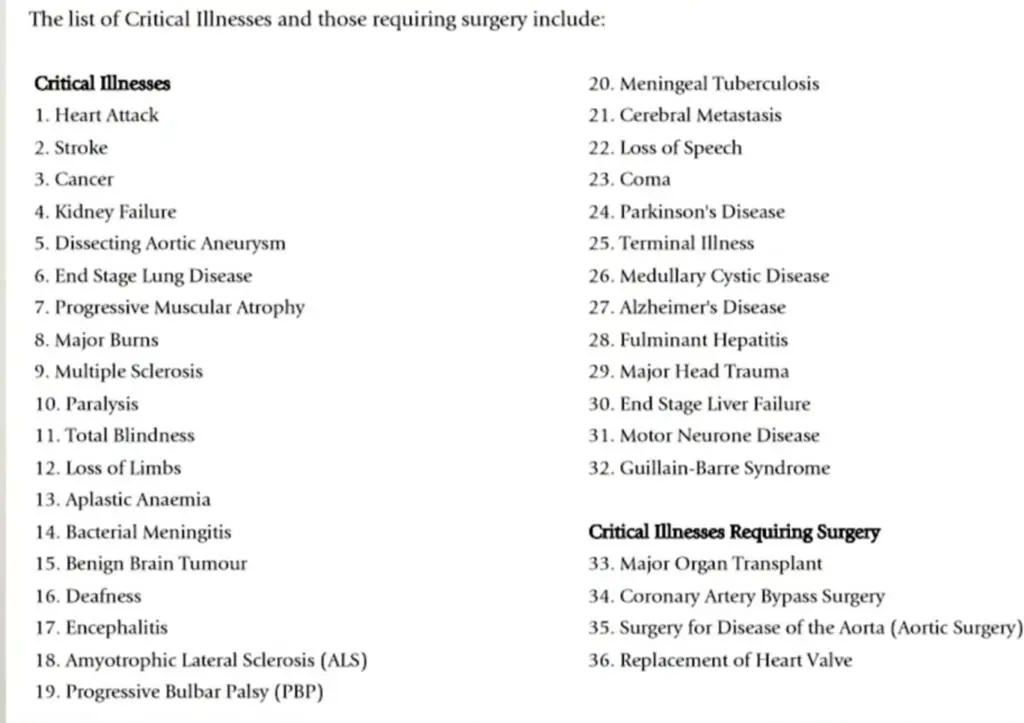

The list of Critical Illnesses and those requiring surgery include:

Critical Illnesses: Heart Attack, Stroke,Cancer, Kidney Failure, Dissecting Aortic Aneurysm, End Stage Lung Disease, Progressive Muscular Atrophy, Major Burns, Multiple Sclerosis, Paralysis, Total Blindness, Loss of Limbs, Aplastic Anaemia, Bacterial Meningitis, Benign Brain Tumour, Deafness, Encephalitis,Amyotrophic Lateral Sclerosis (ALS), Progressive Bulbar Palsy (PBP), Meningeal Tuberculosis, Cerebral Metastasis, Loss of Speech, Coma, Parkinson’s Disease, Terminal Illness, Medullary Cystic Disease, Alzheimer’s Disease, Fulminant Hepatitis, Major Head Trauma, End Stage Liver Failure, Motor Neurone Disease, Guillain-Barre Syndrome।

Critical Illnesses Requiring Surgery: Major Organ Transplant, Coronary Artery Bypass Surgery, Surgery for Disease of the Aorta (Aortic Surgery), Replacement of Heart Valve

Video credit- steph sesa